Property Tax – Hawai‘i County

Are you farming in Hawai’i County and wondering how to apply for agricultural tax programs to lower your property taxes? This webpage will walk you through eligibility, application deadlines, and helpful resources for Hawaiʻi County’s three agricultural use dedication tax programs.

Introduction to Agricultural Property Taxes and Agricultural Programs in Hawai‘i County

The property tax assessment for agricultural land in Hawai‘i County begins with determining land value based on its use. Property tax exemptions or dedications lower taxes by reducing the land value and apply if the property qualifies under categories such as agricultural, home, disability, charitable and miscellaneous, public utilities, or Kuleana land exemptions. For example, the home exemption is applicable to people aged 60 or over, and the amount varies by age range, with an additional exemption of 20% of the assessed value of the property, not to exceed $100,000. After applying the relevant exemptions, the property is generally taxed at either the Agricultural and Native Forest tax rate (hereafter referred to as the Agricultural rate) or the Homeowner rate. Currently, the Homeowner tax class rate is lower than the Agricultural rate. As of June 2025, the Homeowner rate is $5.95 per $1,000 (equivalent to 0.595%), while the Agricultural rate is $9.35 per $1,000 of net taxable value (equivalent to 0.935%). To qualify for the Homeowner tax class rate, the property must be used exclusively as the owner’s principal residence for more than 200 calendar days per year, and the owner must file both a Hawai‘i resident income tax return and a claim for the home exemption.

Hawai‘i County’s Agricultural Use Programs give tax benefits to landowners who engage in agriculture by assessing land value low. In 2023, the Hawai‘i County Council introduced changes to the Agricultural Use Programs. The overarching goal of these changes is to support the statewide initiative to double Hawai‘i’s food supply by 2030. These new programs provide tax incentives to property owners who actively contribute to local food sustainability, while also establishing mechanisms to ensure proper and ongoing use of the agricultural dedication program.

The newly introduced Agricultural Use Programs are:

- Community Food Sustainability (CFS) Program

- Dedicated Agricultural Use Program available in 3-year and 10-year options

Program Eligibility

These programs are designed to promote and support active agricultural use of land. The CFS program offers a flexible, low-barrier option for entry, making it more accessible to a broad range of landowners. In contrast, the 3-year and 10-year Dedicated Agricultural Use Programs require longer commitments but offer greater tax benefits. Property use may transition from a shorter-term program to a longer one; however, switching from a longer-term dedication to a shorter one may involve additional requirements or limitations.

The table below provides a brief overview of the key differences between the CFS, 3-Year, and 10-Year Dedicated Agricultural Use Programs:

| Category | CFS Program | 3-Year Dedicated Program | 10-Year Dedicated Program |

| Flexibility | High: year-to-year commitment; easy to enter or exit | Moderate: 3-year commitment | Low: 10-year commitment |

| Tax Benefits | Tax rate applied to 30% of market value of land | Lower land tax than CFS | Lowest land tax |

| Recordation at Bureau of Conveyances | Not recorded | Not recorded | Recorded; subject to rollback taxes if breached |

| Requirements | Submit one of the following: – Farm plan – USDA organic certification – Conservation plan – Food safety certification – Minimum $10k in receipts | Submit one of the following: – Farm plan – USDA organic certification – Conservation plan – Food safety certification – Minimum $10k in receipts | Submit one of the following: – Farm plan – USDA organic certification – Conservation plan – Food safety certification – Minimum $10k in receipts – Agricultural conservation easement |

| Renewal | One of the following is needed: – $1k in annual receipts documented via GE Tax filings – 501(c)(3) donations over 5 year | Submit as a new dedication | Submit as a new dedication |

Application Deadlines

For the 3-Year and 10-Year Dedicated Agricultural Use Programs, applications are due by September 1 of the given year. Approved applicants will begin receiving tax benefits starting July 1 of the following fiscal year. For the CFS Program, the application deadline is December 31, and tax benefits begin on July 1 of the following fiscal year. Landowners who have participated in the Non-Dedicated Agricultural Use Program have different application and renewal deadlines, so please refer to the Decision-Making Aid Flowchart below.

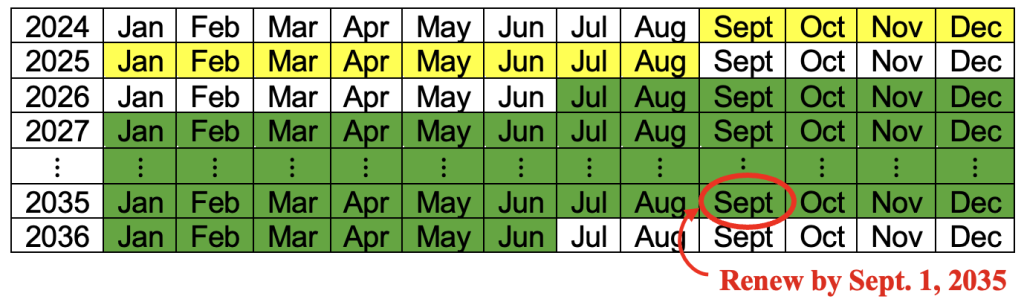

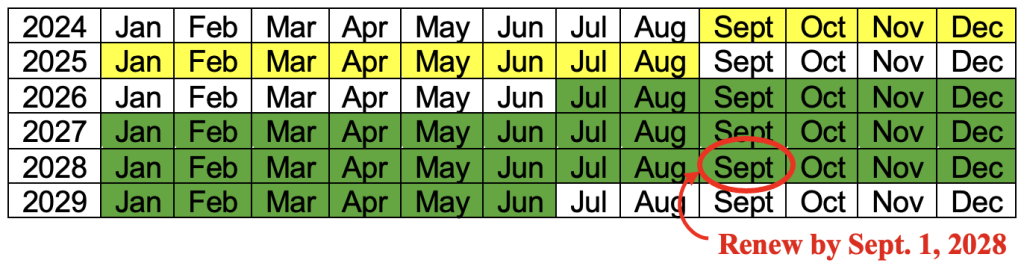

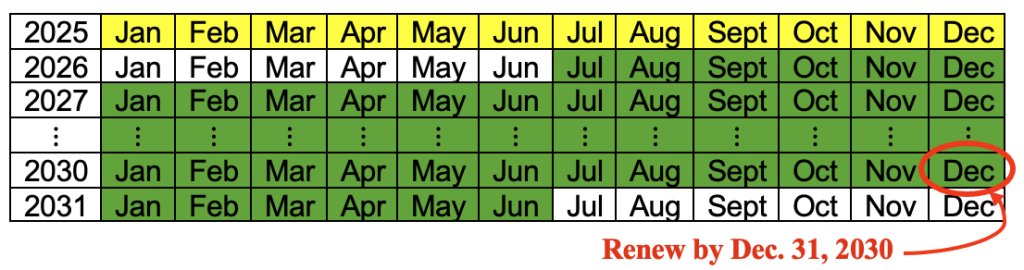

The tables below show an example of application periods and the corresponding benefit periods for each program. In each table, the application period is highlighted in yellow, and the benefit period is highlighted in green.

![]() For the 10-Year Dedicated Agricultural Use Program, if you apply between September 2, 2024 and September 1, 2025, the benefit period will be from July 1, 2026 to June 30, 2036. For renewal, you need to apply by September 1, 2035.

For the 10-Year Dedicated Agricultural Use Program, if you apply between September 2, 2024 and September 1, 2025, the benefit period will be from July 1, 2026 to June 30, 2036. For renewal, you need to apply by September 1, 2035.

For the 3-Year Dedicated Agricultural Use Program, if you apply between September 2, 2024 and September 1, 2025, the benefit period will be from July 1, 2026 to June 30, 2029. For renewal, you need to apply by September 1, 2028.

For the CFS Program, if you apply between January 1, 2025 and December 31, 2025, the benefit period will be from July 1, 2026 to June 30, 2031. For renewal, you need to apply by December 31, 2030.

Resources and Links

For more detailed information, please refer to the Hawaii County Property Tax Office resources:

Decision-Making Aid Flowchart

To help you determine which program best fits your needs, the decision-making flowchart below outlines key considerations for each of the three programs.

Property Tax Calculator (Estimate Only)

A property tax calculator is created to provide an estimated tax amount based on different land uses and program participation.

Please Note: This calculator provides an estimate only. The actual tax amount will differ based on your specific tax class, eligibility for exemptions, and other factors. It is highly recommended to consult with the Hawaii County Property Tax Office or your financial advisor if you need a precise calculation.